Bonus: 100%

XM Review

Program Details

- Cyprus Securities and Exchange Commission (CySEC) (License No. 120/10)

- Australian Securities and Investments Commission (ASIC) (License No. 443670)

- International Financial Services Commission (IFSC) (License No. IFSC/60/354/TS/18)

- Dubai Financial Services Authority (DFSA) (License No. F003484)

$30.00

Introduction to XM

XM, established in 2009, has rapidly become a leading global broker in the online trading space. Headquartered in Limassol, Cyprus, XM now has offices in major financial hubs including London, Sydney, and Athens. XM prides itself on providing a user-friendly trading experience, offering fast execution, competitive spreads, and a variety of platforms suitable for both new and experienced traders. The broker serves over 5 million clients in nearly 200 countries, reflecting its global reach and reliability.

Regulation and Licenses

XM is a heavily regulated broker, providing a secure and transparent trading environment for its clients. The broker is authorized and regulated by several prestigious regulatory bodies:

| Regulatory Body | License Number | Jurisdiction |

|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 120/10 | Europe |

| Australian Securities and Investments Commission (ASIC) | 443670 | Australia |

| International Financial Services Commission (IFSC) | IFSC/60/354/TS/18 | International |

| Dubai Financial Services Authority (DFSA) | F003484 | Middle East |

These regulatory bodies ensure that XM adheres to strict rules related to financial transparency, customer protection, and trading practices.

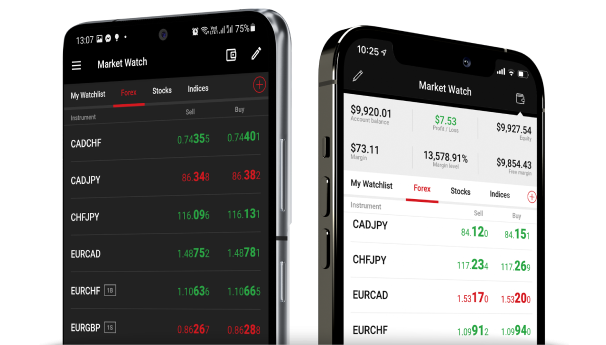

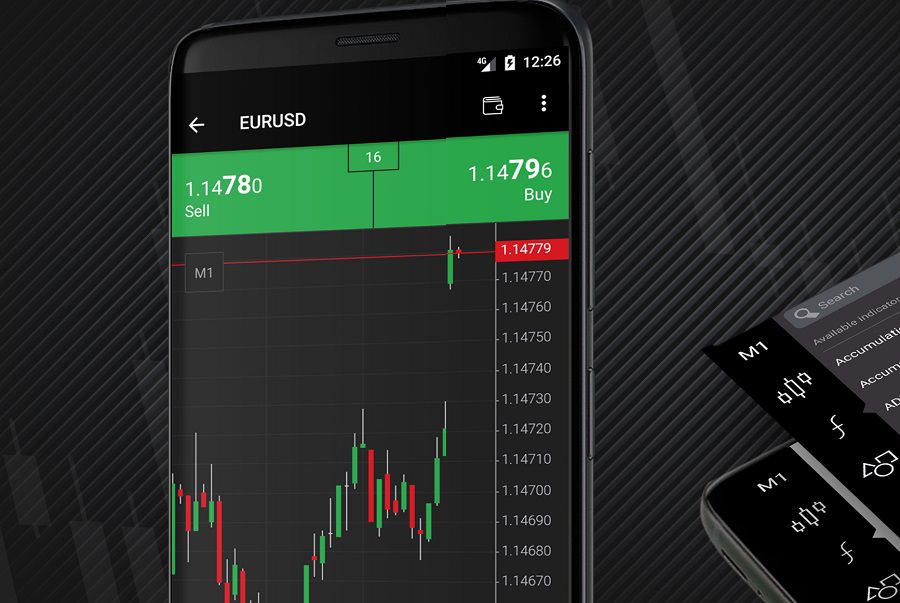

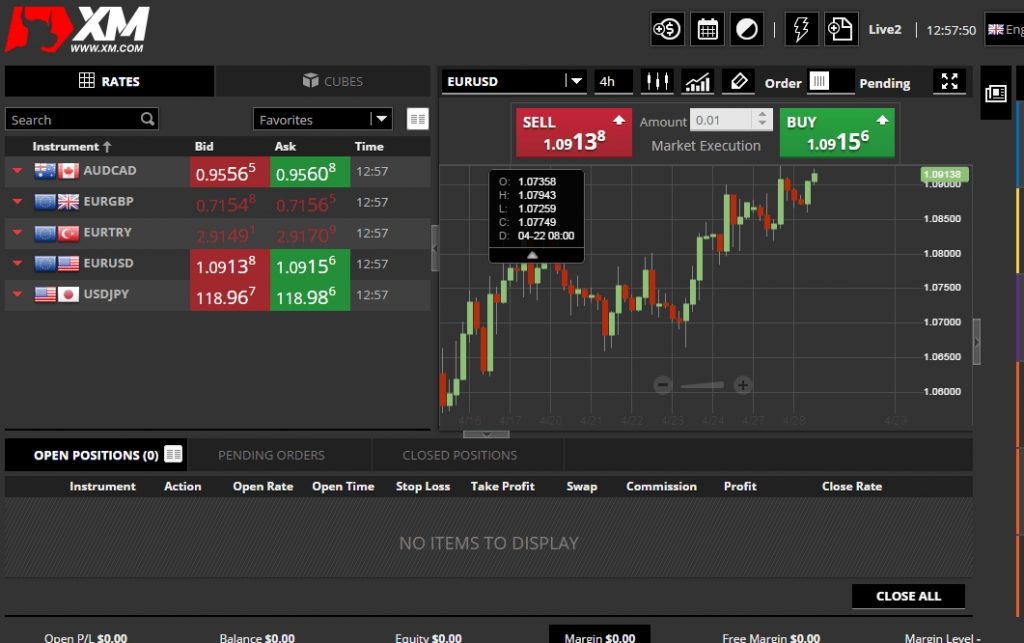

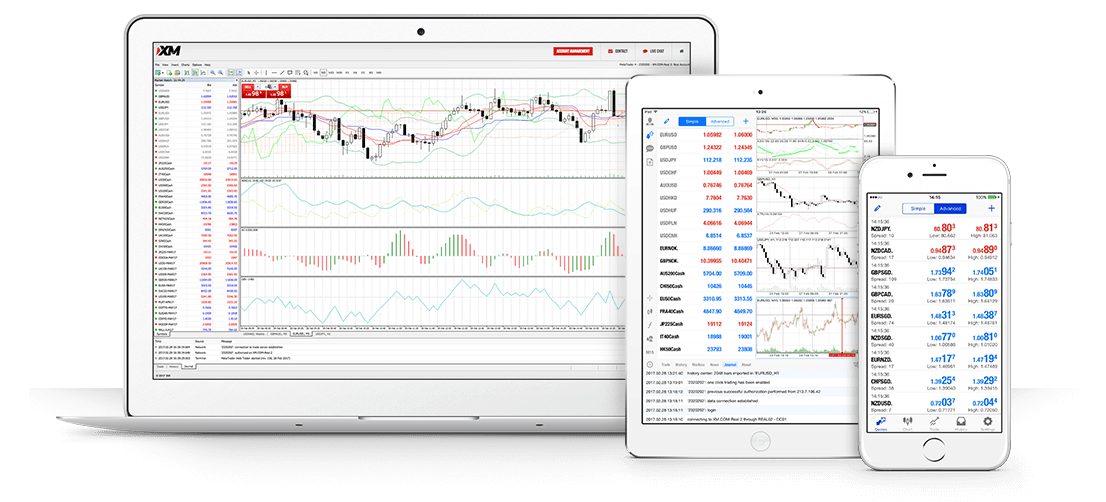

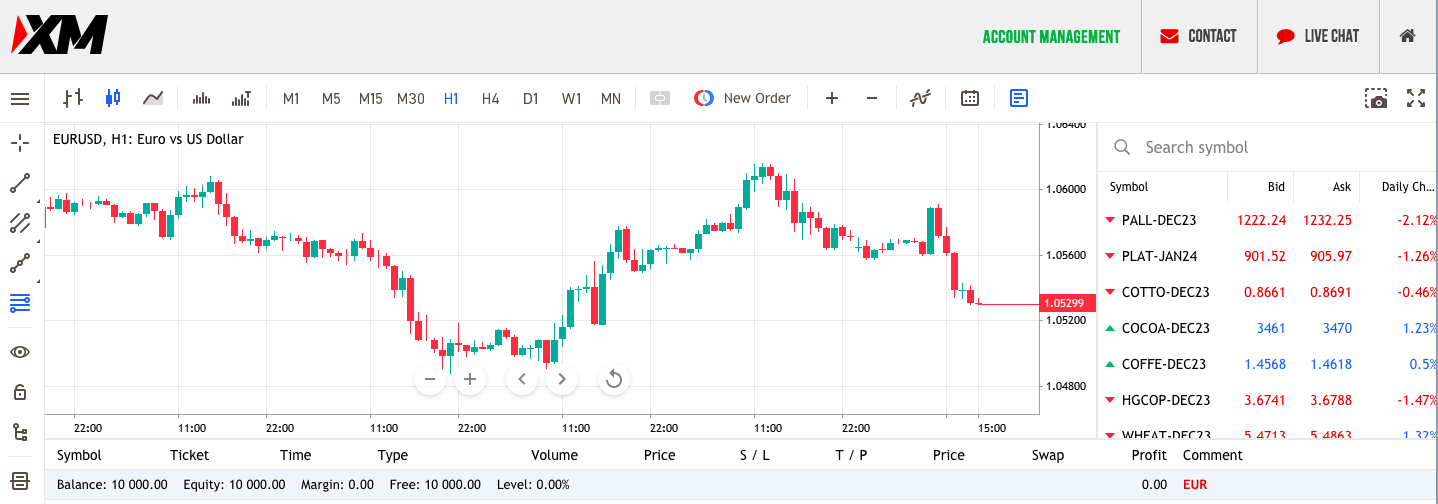

Trading Platforms

XM offers traders a range of platforms, catering to various needs. The platforms provided by XM ensure accessibility from multiple devices and offer robust trading tools for technical analysis and trade execution.

| Platform | Desktop Version | Mobile Version | Web Version | Key Features |

|---|---|---|---|---|

| MetaTrader 4 (MT4) | Yes | Yes | Yes | Suitable for Forex trading, 30 indicators |

| MetaTrader 5 (MT5) | Yes | Yes | Yes | Multi-asset trading, 38 indicators |

| WebTrader | No | No | Yes | Trade from any browser, no installation |

- MetaTrader 4 (MT4) is the more established platform, widely known for forex trading.

- MetaTrader 5 (MT5) is more comprehensive, supporting additional asset classes such as stocks and commodities.

- WebTrader allows traders to trade directly from their browser without downloading any software.

Asset Classes and Trading Instruments

XM offers a wide variety of trading instruments across multiple asset classes, allowing traders to diversify their portfolios:

| Asset Class | Number of Instruments | Example Products |

|---|---|---|

| Forex | 57+ currency pairs | Major, minor, exotic pairs (EUR/USD, GBP/JPY) |

| CFD Stocks | 300+ global stocks | Tesla, Apple, Amazon |

| Commodities | 8 major commodities | Coffee, Wheat, Sugar, Cocoa |

| Equity Indices | 30+ indices | S&P 500, Nasdaq 100, FTSE 100 |

| Metals | 2 metals | Gold, Silver |

| Energies | 5 energy products | Crude Oil, Natural Gas |

| Cryptocurrencies (MT5 only) | 5 cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) |

This wide array of products ensures that traders have access to multiple global markets and can tailor their trading strategies based on different instruments.

Account Types

XM offers four types of trading accounts, each designed to suit various levels of trading experience and strategies:

| Account Type | Minimum Deposit | Spreads | Leverage | Suitable For |

|---|---|---|---|---|

| Micro | $5 | From 1 pip | Up to 1:888 | Beginners, small trades |

| Standard | $5 | From 1 pip | Up to 1:888 | Intermediate traders |

| Ultra-Low | $50 | From 0.6 pips | Up to 1:888 | Advanced traders, scalpers |

| Shares Account | $10,000 | Variable | No leverage | Stock traders |

Each account type offers different advantages. The Micro Account is perfect for beginners who want to trade in smaller lot sizes, while the Ultra-Low Account is designed for experienced traders seeking tighter spreads and more cost-effective trades. The Shares Account is aimed at stock traders and does not offer leverage.

Spreads, Commissions, and Fees

XM offers competitive spreads and a transparent fee structure, allowing traders to minimize costs. Spreads vary based on the account type and asset traded:

- Spreads: XM provides tight spreads, with EUR/USD starting from 0.6 pips on Ultra-Low accounts and 1 pip on other accounts.

- Commission: No commissions are charged on the Micro, Standard, and Ultra-Low accounts. Commissions are only applicable to the Shares Account.

- Leverage: Up to 1:888 for forex, while cryptocurrencies offer a maximum leverage of 1:5.

- Swap Fees: XM charges overnight swap fees, but Islamic accounts are available for swap-free trading.

Deposit and Withdrawal Options

XM offers multiple deposit and withdrawal methods, catering to traders globally. Most transactions are free of fees, and funds are processed quickly:

| Transaction Type | Available Methods | Processing Time | Fees |

|---|---|---|---|

| Deposit | Debit/Credit Cards, Bank Wire, Skrill, Neteller | Instant for most methods | Free |

| Withdrawal | Debit/Credit Cards, Bank Wire, Skrill, Neteller | 24 hours for most methods | Free for most methods |

XM ensures that traders can manage their funds easily, with a variety of local and international payment options.

Educational Resources and Support

XM offers comprehensive educational tools, ensuring that traders can constantly improve their knowledge and skills:

Webinars: Free online webinars are hosted regularly, covering a range of topics from technical analysis to advanced strategies.

Seminars: XM hosts trading seminars in multiple countries, offering in-depth training and market insights.

Trading Tools: XM provides access to economic calendars, trading signals, and calculators to help traders make informed decisions.

XM’s 24/5 customer support is available in multiple languages, ensuring traders can get help whenever they need it.

Pros and Cons

Here’s a quick breakdown of the pros and cons of trading with XM:

| Pros | Cons |

|---|---|

| Highly Regulated: Licensed by CySEC, ASIC, IFSC, DFSA. | No U.S. Clients: XM is not available to U.S. residents. |

| Low Minimum Deposit: Only $5 required to start trading. | Limited Cryptocurrency Offerings: Only 5 crypto pairs. |

| Fast Order Execution: 99.35% of orders executed in under 1 second. | No Fixed Spread Account: Spreads fluctuate with market conditions. |

| Wide Range of Instruments: Over 1,000 trading instruments. | Commission on Shares Account: Trading stocks incurs a fee. |

| Educational Resources: Free webinars, seminars, and trading tools. | Support Only 5 Days: Customer support is not available on weekends. |

Conclusion

XM is a versatile broker, providing a broad range of asset classes, a choice of trading platforms, and competitive spreads with no commission on most trades. With its commitment to regulation and customer service, it is ideal for both new traders looking for a secure entry into forex and experienced traders seeking tight spreads and flexible leverage. XM’s dedication to providing educational resources and exceptional support further enhances its reputation as one of the leading global brokers.

Be the first to review “XM Review”

You must be logged in to post a review.

Social

Fx List

New List

Scam List

Bonus: 30%

Bonus: 100%

Reviews

There are no reviews yet.